There are several reasons why you should have a business bank account for your limited company. A dedicated bank account will separate your business and personal finances, help you establish a credit rating, add credibility to your business, and open up the opportunity for additional funding if required.

As a Rapid Formations customer, you can take advantage of our relationship with the UK’s leading banks, and start the application process at the same time as registering your company or afterward, through your Online Client Portal. Wherever is more convenient for you. Both options are an easy way to get your business bank account sorted.

In this article, we show how to use our website to select the business bank account that’s right for you and your company.

The banks we work with

Our UK-based customers can opt-in to a business bank account with the following banks and banking service providers:

- Barclays

- NatWest

- Tide

- Monzo

- Zempler

- Anna

- HSBC

- Wise (also available to our non-UK based customers)

Generally, these can all be selected during the company formation process or once the company has been formed. However, sometimes not all banks will be available to you. This can be because of the SIC code your company is using or due to service limitations from the provider at the time.

Now, let’s look at how you can select your business bank account.

Selecting your business bank account during the company formation process

All of our company formation packages come with the option to opt-in to a business bank account during the company formation process (apart from our Non-Residents Packages which includes a Wise referral – see the relevant section below if you are a non-UK resident).

To choose your business bank account during the company formation process, you will need to have selected and paid for your company formation package, and then be working your way through the process.

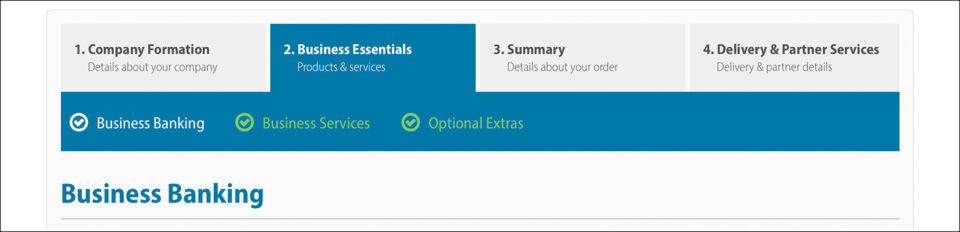

1. Once you have completed the ‘Company Formation – Details about your company’ section (this entails providing information about your registered office address, directors, people with significant control, shareholders, and shares), you will reach the ‘Business Essential – Products and services’ step.

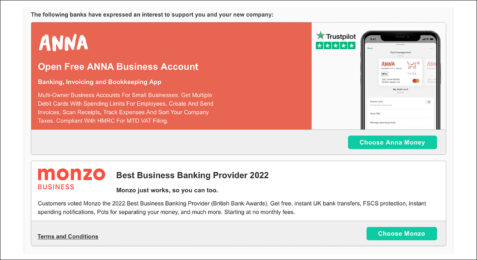

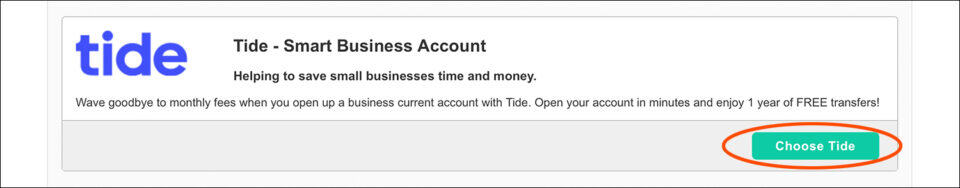

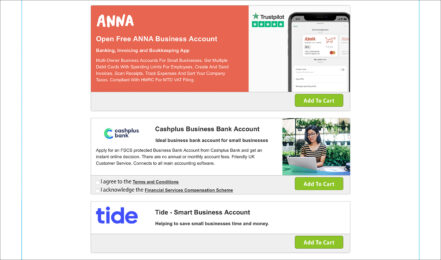

2. You will be directed straight to the dedicated ‘Business Banking’ area, where you will be presented with some of the banks that are available to you.

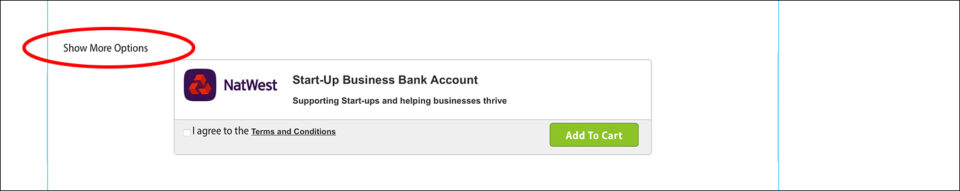

3. Select the ‘Show More Options’ link to see more banks.

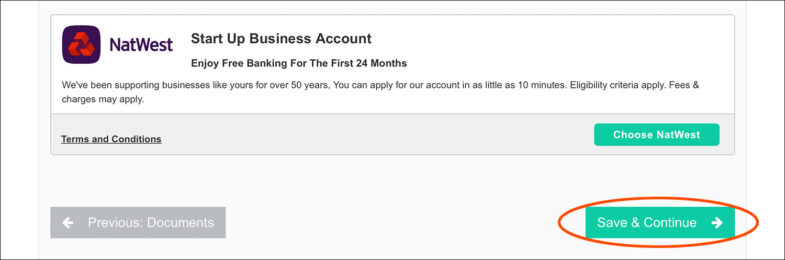

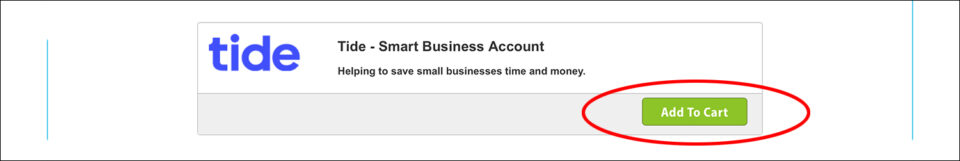

4. Select the ‘Choose’ button next to the bank that you wish to open an account with.

5. Once you have made your selection, click the ‘Save & Continue’ button.

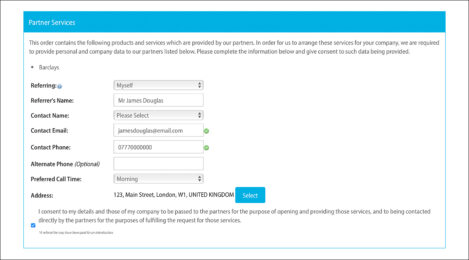

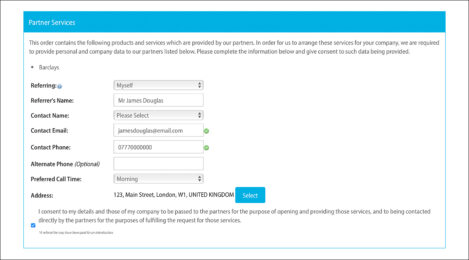

6. Continue to work your way through the company formation process. This will require you to select any other additional partner services that you are interested in, review all the information that you have provided, and critically for your bank account application, check over the ‘Partner Services’ information. This is the information that the bank will use to contact you, so ensure it’s completed correctly.

7. When you are happy with all the information that you have provided, agree to the necessary terms and conditions and select ‘Submit’.

Your application will then be sent to Companies House, where it will typically be accepted within 24 hours (if you opted-in to our Pre-Submission Review Service, our team will review your application before it’s sent to Companies House).

Your chosen banking provider will then be in contact, generally within 2 working days, to assist you in opening your business bank account.

Selecting your business bank account after your company has been formed

If you registered your limited company with Rapid Formations but did not select a business bank account during the formation process, don’t worry – you can still take advantage of our various banking partnerships. To do this:

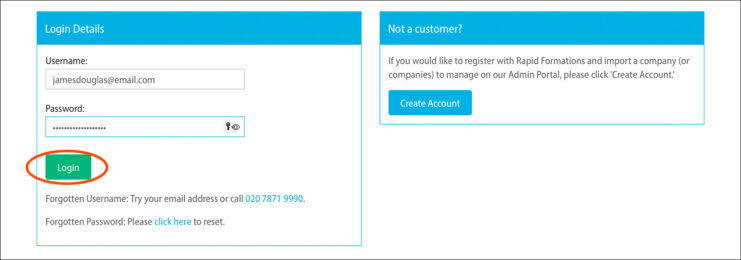

1. Log in to your Online Client Portal.

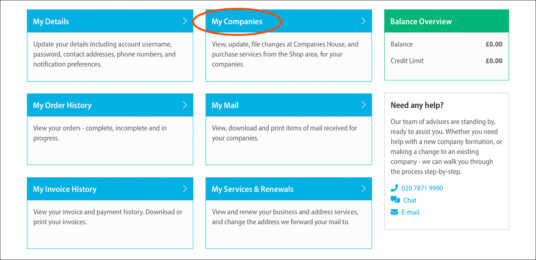

2. Select ‘My Companies’.

3, Click on your company name.

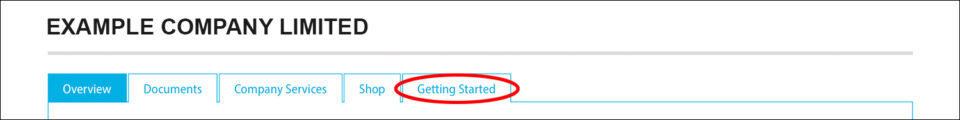

4. Select the ‘Getting Started’ tab.

5. You will be directed to the dedicated ‘Business Banking’ area, where you will be presented with some of the banks that are available to you.

6. Select the ‘Show More Options’ link to see more banks.

7. Select ‘Add to Cart’ next to the bank that you wish to open an account with and proceed to the cart area.

8. You will be directed to the ‘Delivery & Partner Services’ page. From here, ensure the information in the ‘Partner Services section is correct – this is the information that the bank will use to contact you.

9. Agree to the necessary terms and conditions and select ‘Submit’.

Your chosen banking provider will then be in contact, generally within 2 working days, to assist you in opening your business bank account.

If you are a non-UK-based customer

Our Non-Residents Packages include the facility to open an account with Wise. If you have purchased either of the Non-Resident Packages, you do not need to select Wise during the company formation process.

Instead, we will send you an ‘Order Fulfillment’ email with a dedicated Wise link as soon as your company has been formed. You simply need to click this to start the application process whenever is convenient for you (this can be straight after your company has been formed or at a later date).

If you are a non-UK resident, but are not using the Non-Residents Packages, you can opt-in to Wise during the company formation process when at the ‘Optional Extras’ step of the formation process. You will then receive your dedicated Wise link as soon as your company has been formed.

If you missed this opportunity during the company formation but now wish to take advantage of our partnership with Wise:

- Log in to your Online Client Portal.

- Select ‘My Companies’.

- Click on your company name.

- Select the ‘Shop’ tab.

- Select ‘Add’ next to ‘WiseBusiness Account Referral’.

- Click on ‘View Cart/Checkout.

- Agree to the necessary terms and conditions and select ‘Submit’

We will then immediately email you the dedicated Wise link that you can use to apply for your account. Account openings for Wise are subject to approval.

Thanks for reading

So there you have it, that’s the easy way to get your business bank account sorted. Follow the instructions covered in this article and tick off an important job for your limited company.

We hope you have found this article useful. Please leave a comment if you have any questions and we’ll get back to you as soon as possible.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.