Self Assessment for directors is a requirement if you receive dividends or any other type of untaxed income from your company in addition to (or instead of) a director’s salary.

You can register for Self Assessment with HMRC online. Each year, you will be responsible for filing your own Self Assessment tax return to report your annual income from all sources. Any personal tax you owe must then be paid to HMRC by 31 January after the end of each tax year.

Key Takeaways

- Limited company directors receiving any form of untaxed income must register for Self Assessment with HMRC.

- The registration deadline is 5 October.

- You can file your tax return online by 31 January or submit a paper return by 31 October.

How to register for Self Assessment

Company directors must register for Self Assessment with HMRC before they can send personal tax returns. This should be done as soon as possible after setting up a company or being appointed to an existing limited company.

The deadline for registering for the current 2025/26 tax year, which runs from 6 April 2025 to 5 April 2026, is 5 October 2026. You will need to provide your personal details, National Insurance number, and the date of your appointment as a director.

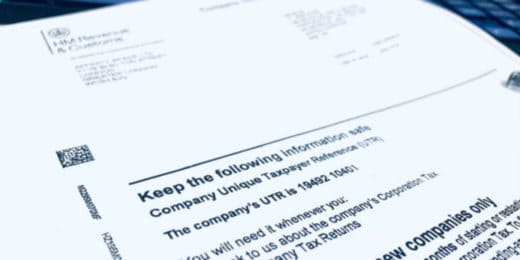

Within a few days of registration, you should receive your personal Unique Taxpayer Reference (UTR) from HMRC. You will need this to sign into HRMC’s online services, send your tax returns, and pay any tax you owe. Your personal UTR is not the same as your company UTR, so be careful not to confuse the two.

How and when to file a Self Assessment tax return

The most popular and convenient option is to file your Self Assessment tax return online. You’ll need to declare all sources of income and capital gains on the return. This includes your director’s salary, expenses, dividends from shares, director’s loans, and any other income you receive from other sources (e.g. employment, rental income, or freelance work).

You pay tax and National Insurance on your director’s salary through PAYE, but you still need to include these earnings on the tax return to determine your total taxable income for the year. You’ll then be able to work out how much tax you owe on dividends or other untaxed income declared on your tax return.

The Self Assessment deadlines for the 2025/26 tax year are as follows:

- If you’re filing a paper tax return – 31 October 2026

- If you’re filing an online tax return – 31 January 2027

- Paying your Self Assessment tax bill – 31 January 2027

- First payment on account for the following year’s tax bill (if applicable) – 31 January 2027

- Second payment on account for the following year’s tax bill (if applicable) – 31 July 2027

HMRC will send letters to your service address, as well as emails, to remind you to prepare a tax return and pay your bill.

You must complete a Self Assessment tax return even if don’t owe any tax on your additional income. If your accounting records and tax returns are complex, it may be worth appointing an accountant.

Late filing penalties

If you miss the October deadline, you can file your tax return online instead. HMRC may impose penalties if your tax return is delivered after the online filing deadline or if you pay your tax bill late.

You can be fined £100 if your tax return is up to 3 months late. This will increase if it is filed even later. You may also be charged penalties and interest if some or all of your tax bill is paid late. This is worked out as a percentage of the total outstanding tax payment.

How to account for an overdrawn director’s loan through Self Assessment

There may be tax implications for a director and a company if a director’s loan account is overdrawn 9 months after the end of the company’s financial year.

The company may have to include details of any director’s loans in its Company Tax Return and pay tax under Section 455 of the Corporation Tax Act 2010. A director may have to include details of any loan in their Self Assessment tax return.

You must report any such director’s loans on your Self Assessment tax returns if:

- you owe the company more than £10,000 at any time during the year

- the company charges you interest on a loan below the official rate of interest (currently 3.75%)

- you do not need to repay the loan because it’s ‘written off’ or ‘released’ by the company

- you charge the company interest on a loan – this is classed as personal income

In addition to reporting a director’s loan and/or interest payments through Self Assessment, directors may have to pay Income Tax and National Insurance contributions on any overdrawn loan amount, any interest earned on a loan made to the company, and any loan that is written off by the company. In each of these cases, the director is earning a form of taxable income.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion

Comments (16)

Hi good morning,

just query about self assessment for director.

If the ltd company year ended is Jan 2022, director’s salaries were taken every month, the director also has two other employment job with two P60 2021/2022. The SA is running from 6th April 2021 to 5th April 2022, so what is the total income need to put in the SA form? total salaries from company is £4,200, dividend is distributed for £2,600, total for two other employment income are £11,000, do i need to add the Feb to 5th April director ‘s salaries when submitting the tax return ? thank you for your help.

Thank you for your kind enquiry, Emmy.

Unfortunately we are unable to provide tax advice as we are not regulated to do so and providing tax advice is a regulated profession.

We would advise speaking to a tax accountant for assistance regarding this matter.

We are sorry we cannot be of more help on this occasion.

Kind regards,

The Rapid Formations Team

Hello

I’m a self-employed freelancer but recently set up a C.I.C for which I am the director. I am not an employee of the company but receive income from the company on a contract basis, alongside my other freelance work. Most of the work I do for the company is on a project basis and not full time. How do I file this on my tax return? Is it as self-employed? Its very confusing

Hi Katy,

Thank you for your kind enquiry.

With regards to how you would fill this in on your tax return, from the scenario you have described, it is likely you would be classified as ‘self-employed’. However, please do not take this as advice – we recommend you liaise with a tax accountant if you are unsure.

We trust this information is of use to you.

Kind regards,

The Rapid Formations Team

Hi, I have a director in my limited company who is not UK resident or tax payer. However, all directors needs to make a self-assesment. He would not be able to get his personal UTR number as he has no NIN. Is this correct? The obligation of making self – assesment does still applies to him?

Many thanks

Hi

Unfortunately, we cannot assist with your question and would advise that you speak to an accountant for advice on this.

Best regards,

Rapid Formations Team

As the sole director of my ltd company, is it obligatory to operate PAYE or I can pay my NI and tax on only dividends I declare on my self assessment?

Dear George

We cannot advise on remuneration from a company, however not every company needs to register for PAYE if the criteria is met by the shareholders for dividend payments to be an option.

Best regards,

Rapid Formations Team

Hi,

I am a director of a Limited company along with one other. We have never received any income from the business. Do we need to register for a Self Assessment each or will this not be required as we have never received any income?

Many thanks in advance,

Alyson

Dear Alyson,

Thank you for your message.

Unfortunately we are not able to advise on taxation matters are we are not accountants. I would suggest you seek professional advice regarding your position.

Best regards,

Rapid Formations Team

When i register for corporation tax does it register me for self assessment also I do I need to register for that as well? Its confusing as it asks if im self employed, sole proprietor or joint partnership when i got to register for self assessment after.

Hi Duncan,

Thanks for getting in touch.

No, you need to register separately for self-assessment. The same goes for VAT and PAYE (if applicable).

As you are a director, use this link to access the required Self-Assessment form: https://www.gov.uk/government/publications/self-assessment-register-for-self-assessment-and-get-a-tax-return-sa1

The registration always seems a bit confusing if you’re a director because you’re not actually ‘self-employed’, even through you’re running your own business.

I hope this helps. Best of luck!

Rachel

but how can I get my utr if they did not give me nin as foreign director in uk?

Hi Robert,

Are you a UK resident? National Insurance Numbers are not issued to non-UK residents.

There is a supplementary page for non-residents in SA tax return: take a look at this guidance and refer to the section ‘Sending a self-assessment tax return’ for more information https://www.gov.uk/tax-uk-income-live-abroad/overview

To speak to HMRC directly about this matter, please contact Self-Assessment general enquiries: https://www.gov.uk/government/organisations/hm-revenue-customs/contact/self-assessment

Best wishes,

Rachel

Where on the self assessment form do details on a directors loan need to be declared (i.e. in which section)? We have a directors loan of more than £10,000 but it is still within the ‘9 months after year end’ period so not due back yet. Where is this declared? Is it considered income? (Did you receive any other UK income, for example, employment lump sums, share schemes, life insurance gains?)

Hi Sarah,

I’m afraid we cannot advice on your situation. Please consult an accountant or tax advisor for guidance.

Best wishes