Limited companies have a range of filing and reporting requirements to perform for Companies House and HMRC on an annual and as-needed basis. It is the responsibility of company officers (directors and secretaries) to submit annual confirmation statements, annual accounts, and Company Tax Returns by their statutory filing deadlines. Corporation Tax must also be paid within a certain timeframe.

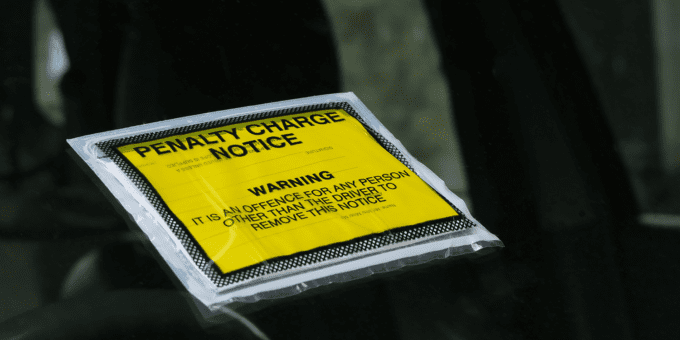

Failure to meet these deadlines so can result in significant late filing penalties. In severe cases, director disqualification and company dissolution can occur.

Key Takeaways

- Directors must file annual accounts within nine months of the financial year-end to avoid severe penalties.

- Late Company Tax Returns incur escalating penalties, emphasising timely filing to minimise financial impact.

- Companies risk dissolution if they fail to submit required confirmation statements, underscoring the importance of compliance.

Confirmation Statement

A confirmation statement must be prepared and filed at least once every 12 months. The deadline is 14 days after the anniversary of:

- company formation (for the first statement)

- the confirmation date of previous confirmation statement (for all subsequent statements)

Every company, including LLPs and dormant companies, must prepare a confirmation statement for Companies House.

It is a criminal offence to fail to deliver at least one confirmation statement to Companies House every year. However, there is no automatic late filing penalty if the statement is delivered late.

If a company fails to deliver one at all, the directors can be personally fined by the criminal courts – and companies can be struck from the register in extreme cases.

Annual accounts

Annual accounts must be prepared by all companies every year, even if a company is not trading. Directors are personally responsible for ensuring annual accounts are delivered to Companies House no later than 9 months after the end of the company’s financial year. The financial year-end is represented by an accounting reference date (ARD).

If a company’s first accounts cover a period of more than 12 months (which they often do), they should be filed with Companies House no later than 21 months after the date of incorporation. Otherwise, the first accounts and all subsequent accounts are due 9 months after the ARD.

If annual accounts are overdue, a company can face a civil penalty and its directors risk personal prosecution and a fine of up to £5,000 each. Failing to file accounts at all will result in a company being struck off the register and dissolved. The current late filing penalties imposed on companies are as follows:

- Up to one month late – £150

- One to three months late – £375

- Three to six months late – £750

- Over 6 months late – £1,500

These late filing penalties will be doubled if a company delivers its accounts late for two consecutive years.

Corporation tax and Company Tax Returns

The deadline for filing Company Tax Returns with HMRC is within 12 months of a company’s Corporation Tax accounting period. Tax returns must be filed even if a company has no tax to pay. Dormant companies, however, are not required to file a return with HMRC.

- Failure to file a tax return on time will result in a flat-rate late filing penalty of £100

- An additional £100 will be charged if the return is filed more than 3 months late

- If a tax return is submitted between 18-24 months late, a company will be fined 10% of its outstanding Corporation Tax liability

- If it is filed more than 24 months late, a further 10% penalty will be imposed

- If a company files a late tax return for three or more consecutive accounting periods, the flat-rate penalty will automatically rise to £500

- An additional £500 charge will be applied if the tax return is then filed more than 3 months late

The deadline for paying Corporation Tax to HMRC is known as the ‘normal due date’ – this is 9 months and one day after the end of a company’s accounting period. Failure to pay tax on time will result in interest being charged on the outstanding tax liability until it is paid off in full.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion