Shares & Shareholders

FAQ Homepage

- Annual Accounts

- Basics

- Companies Limited by Guarantee

- Companies Limited by Shares

- Company Formation Process

- Company Meetings and Resolutions

- Company Names

- Company Records and Registers

- Company Secretary

- Confirmation Statement

- Corporation Tax

- Directors

- Limited Liability Partnerships

- Pay As You Earn (PAYE) and Payroll

- Paying Yourself Through a Limited Company

- People With Significant Control (PSCs)

- Post Incorporation

- Registered Office

- SAIL Address

- Self Assessment

- Service Address

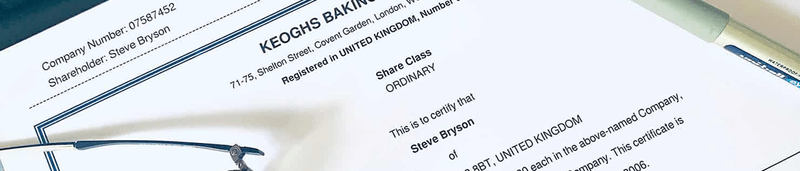

- Shares & Shareholders

- VAT

How we are rated

Register your company today

Included with your package is a bank account from one of our partners.