A financial health check is your opportunity to step back and objectively assess your company’s financial and operational well-being. It helps identify inefficiencies and make informed adjustments to stay on track to achieve your business goals.

Conducting regular financial health checks is key, whether you’re running a small business or scaling an SME. This guide will show you how to do it confidently and effectively.

Key Takeaways

- Regular financial business health checks help SMEs spot early warning signs, such as unstable cash flow or falling profit margins.

- Using digital tools simplifies ongoing tracking of key metrics and strengthens decision-making through real-time financial insights.

- A complete business health check looks beyond the numbers and may also assess leadership alignment, operational efficiency, and digital readiness.

What is a financial health check?

A financial health check is a structured review of your business’s performance, with a specific focus on your financial data. It involves analysing key financial indicators (such as profit margins and cash flow) to assess whether your organisation is thriving or just surviving.

Unlike a one-off audit or statutory financial reporting, a financial business health check is a proactive and recurring review. It’s designed to give you early visibility of potential issues and opportunities, supporting better planning and agility.

Why should I do a health check for my business?

A financial check-up aims to assess current performance, identify potential risks before they become critical, and highlight areas for improvement.

Financial reviews are essential, especially for SMEs. Resources are often stretched, and signs of strain can show quickly. Regular health checks help you manage this pressure by evaluating your company’s financial well-being and accessing essential insights needed to make confident, data-driven decisions.

Key indicators for SME financial health

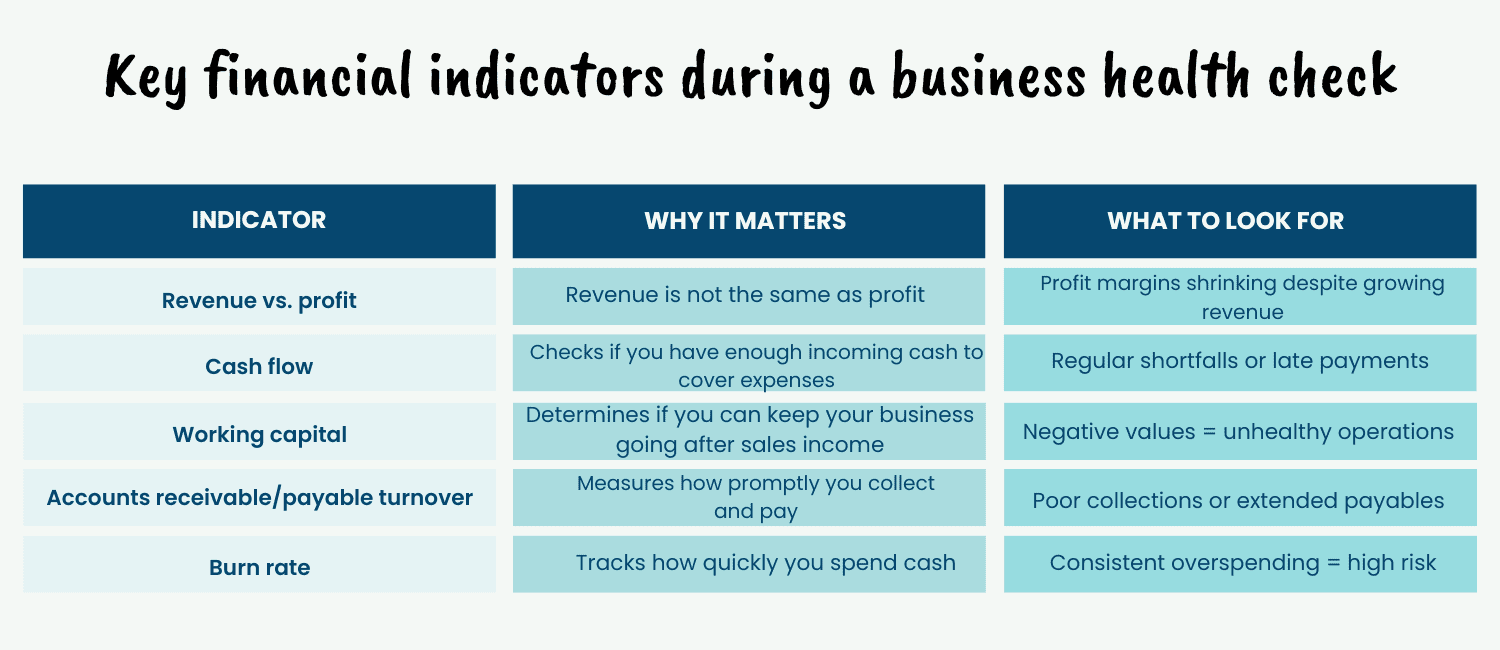

The table below outlines key financial indicators that form a practical checklist for assessing your business’s financial health.

Leverage these key performance indicators (KPIs) to systematically evaluate your business’s performance relative to your original financial projections and strategic goals.

Regularly monitoring these metrics enables you to track progress, identify trends, and assess whether you are on course to meet your targets.

When discrepancies between actual results and projected outcomes emerge, they can serve as early warning signs of underlying issues. Such variances warrant a thorough investigation to uncover their root causes and implement corrective actions, helping to safeguard the health and sustainability of your business.

How to know if a company is doing well financially

A business financial health check is a valuable way of evaluating how a company is performing financially. Generally, financial health is on track if the company maintains positive working capital, healthy margins, and stable cash flow.

Digital tools like Float or Excel-based dashboards can make financial monitoring easier. For more robust insights, accounting software like Xero or QuickBooks includes built-in analytical features for small business owners.

Graeme Donnelly, CEO and Founder at Rapid Formations and BSQ Group advises:

Understanding your company’s financial health isn’t just about reviewing profits, it’s about having a clear picture of cash flow, operational efficiency, and long-term sustainability. A financially healthy business knows where it stands today and can confidently plan for tomorrow. Regular financial health checks act like a business’s vital signs – when they’re strong and consistent, it’s a sign the company is on solid ground and positioned to grow.

The three core financial statements you should know

Understanding your financial health begins with three key documents: a balance sheet, a profit and loss statement, and a cash flow statement. Each of these gives you a unique view of how your business is performing, and together, they build a comprehensive picture.

1. Balance sheet

A balance sheet is a snapshot of your company’s financial position at a specific point in time.

It shows what the business owns (assets), what it owes (liabilities), and the owner’s equity – essentially, what the business is worth after debts are paid. It follows the formula:

Assets = Liabilities + Equity. By reviewing your balance sheet, you can quickly assess the company’s financial stability, liquidity, and overall health.

2. Profit and loss statement

Also known as an income statement, a profit and loss statement tracks your company’s performance by analysing its income, expenses, and profit over a set period. It helps give you an insight into revenue trends and operational health.

Take a look at our EBITDA blog for help with structuring your profit and loss statement.

3. Cash flow statement

A cash flow statement tracks the movement of money into and out of your business over a set period.

It’s divided into three key sections: operating activities (like customer payments and supplier expenses), investing activities (such as purchasing equipment), and financing activities (like loan repayments or investor funding).

Positive cash flow indicates your business can comfortably meet its short-term obligations and reinvest in growth. To simplify the process, consider using a cash flow calculator to quickly forecast monthly cash flow and identify potential gaps or surpluses.

Author's Tip

Building your SME health check process

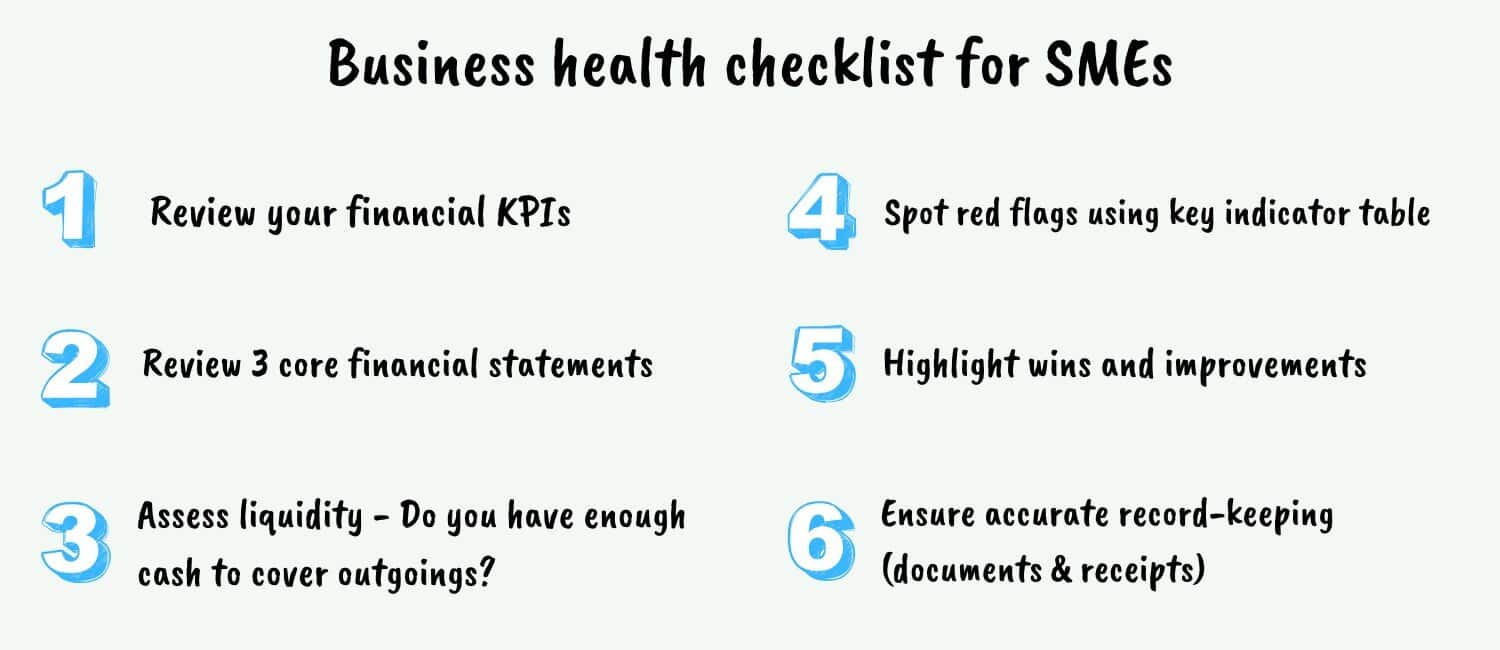

A reusable, data-driven business health checklist makes financial reviews quick and actionable. Here’s a simple step-by-step guide on how to approach this:

Establish a routine of conducting quarterly reviews with your accountant to strengthen your organisation’s internal controls and maintain financial accuracy.

These scheduled sessions provide an opportunity to proactively identify potential financial or operational risks before they escalate, ensure compliance with regulations, and assess the validity of business assumptions that underpin your strategic decisions.

Regular engagement with your accountant supports informed decision-making and reinforces financial discipline across your operations.

Common red flags and how to solve them

Financial imbalances within a business can often begin with subtle warning signs that are easily overlooked in day-to-day operations. However, recognising these early indicators is critical to preventing more serious financial issues down the line.

Below is a list of some of the most common red flags that may signal trouble, ranging from low cash reserves to declining gross margin, along with practical and straightforward corrective actions you can take to address them promptly.

By monitoring these indicators regularly, you can maintain greater financial stability, make informed decisions, and ensure the long-term health of your business.

In the words of our CEO:

The earlier you identify financial issues, the easier – and more cost-effective – they are to resolve. Being proactive rather than reactive can save your business time, money, and stress. That’s why regular financial reviews are good practice, and essential for maintaining control and making informed decisions before problems escalate.

Tools to make your financial health checks easier

Managing your business finances doesn’t have to be time-consuming or manual. Today’s accounting software helps streamline financial management by automating routine tasks and centralising key data, all in real time. This saves time and improves accuracy and decision-making.

Here are some top app recommendations to help you keep your financial health on track:

-

Xero / QuickBooks – Intuitive, cloud-based accounting platforms that automate tasks like invoicing, bank reconciliation, and expense tracking. Ideal for small to medium-sized businesses.

-

Float – A powerful cash flow forecasting tool that integrates with your accounting software to give you real-time visibility and control over liquidity.

-

Fathom / Joiin – Advanced reporting and dashboard tools that support detailed performance analysis, multi-entity consolidation, and scenario planning. Perfect for strategic decision-making.

All of these tools offer free trials or demos, so you can explore which solution best suits your business size, goals, and financial experience. Choosing the right ones can help you stay financially informed and future-focused.

Suggested check-in timeline

If you’re wondering how often you should conduct a financial health check, there’s no one-size-fits-all approach, but a regular schedule supports stronger financial awareness. We generally recommend:

- Daily to weekly Key Performance Indicator (KPI) checks, like cash balances and invoice levels

- Monthly reviews of your business income and expenses as part of your three core financial statements

- A comprehensive business health check once every quarter

Sticking to a consistent review schedule helps mitigate potential issues before they escalate. These routine habits will help you build long-term financial confidence.

What else should a business health check cover?

Broadening your business health check to include non-financial indicators will help identify risks (such as leadership gaps, inefficient processes, and outdated tech) that numbers alone can’t always reveal. Alongside financial metrics, consider these three strategic indicators in your assessment:

1. Leadership and vision

Do you have clear business goals documented and strategies to reach them, with measurable outcomes? Stay focused by regularly ensuring that your senior management team is strong and adaptable, helping to fuel stability even when external conditions change.

Author's Tip

2. Operational efficiency

Are your workflows repetitive or overly manual? Are your customer acquisition costs going up? These are questions that point to operational inefficiency.

Review your operations regularly to boost efficiency and focus on growth. Even small automation or outsourcing changes, such as using a Full Company Secretary Service to help with your company secretarial requirements, can save you time and money.

Author's Tip

3. Digital readiness

Are you using the right technology for your growth stage, and can you scale it easily? Conduct regular digital audits (for instance, assess software performance and technology integration) to ensure you invest in the right tools to support evolving business needs.

Author's Tip

Graeme Donnelly has this to say about non-financial indicators:

Financial performance is only one side of the story. To truly understand your business’s health, you need to assess what’s happening behind the numbers. Consider your leadership, operations, and technology.

These non-financial factors are often the early warning signs of risk or the untapped levers for growth. A strong business health check looks beyond the balance sheet to ensure the whole organisation is fit for the future.

Take charge of your business’s financial health

A financial health check is a vital habit that builds resilience and confidence by helping you anticipate risks and make data-led decisions for your business. By monitoring your financial metrics, you can keep your business on track and plan for sustainable growth.

Ready to build your financial confidence? Start by learning the 25 financial terms every business owner should know. If you’re looking for support in your next stage of business growth, discover the tailored advice and expert-led services we offer.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion